[ad_1]

NEW DELHI: The combination of monetary policy stance and macroprudential measures by the central bank, and structural factors, may have contributed to slowdown in demand, a finance ministry report said on Thursday in the latest sign of divergent views between North Block and the Reserve Bank of India (RBI) over growth and inflation. This is the first official comment from the ministry about the slowdown, which appears to put part of the blame on RBI.

Growth slumped to a seven quarter low of 5.4% in the July-Sept and pressure piled on RBI to cut rates to revive growth, while the central bank maintained its focus on containing inflation and preferred to hold rates for the 11th consecutive time in Dec, citing stubborn inflation. Slowing urban consumption has also worried policymakers battling to put growth back on track.

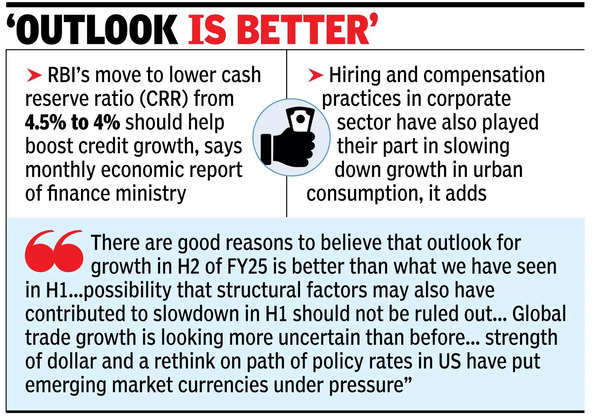

“…There are good reasons to believe that the outlook for growth in H2 (second half) of FY25 is better than what we have seen in H1 (first half). At the same time, the possibility that structural factors may also have contributed to the slowdown in H1 should not be ruled out,” the finance ministry’s monthly economic report said, appreciating the central bank’s move to lower the cash reserve ratio (CRR) from 4.5% to 4% in its policy meeting in Dec 2024.

The move, the report said should help boost credit growth, which has slowed a little too much and quickly in financial year 2024-25. It also stressed that hiring and compensation practices in the corporate sector have also played their part in slowing down growth in urban consumption.

There are expectations that RBI may cut rates in Feb under a new-look monetary policy and a new governor Sanjay Malhotra, former revenue secretary who replaced Shaktikanta Das earlier this month but some experts have said that a rate reduction in Feb may prove tricky against the backdrop of global uncertainties.

Finance minister Nirmala Sitharaman had earlier said that a slowdown in govt spending during April-June quarter was due to general elections and was hopeful of a pick-up from the current quarter. The report asserted that growth in the current fiscal year would be 6.5% but cautioned about newer uncertainties emerging on the global stage.

“Global trade growth is looking more uncertain than before. Elevated stock markets continue to pose a big risk. The strength of US dollar and a rethink on the path of policy rates in the US have put emerging market currencies under pressure,” said the report prepared by the department of economic affairs. “In turn, that will make monetary policymakers in these countries think more deeply about the path of policy rates. Recent exchange rate movements may have lowered their degrees of freedom. In sum, sustaining growth will require a deeper commitment from all economic stakeholders to growth,” it added.

Stating that inflationary pressures softened in Nov 2024, driven by lower food and core inflation, the report said that an influx of fresh produce in the market has moderated vegetable price pressures.

[ad_2]

Source link